Architetto

Pier Giacomo Castiglioni

Pier Giacomo Castiglioni è stato un architetto designer urbanista docente Italiano del XX secolo.

Oggi è riconosciuto come una figura di spicco nel mondo del design internazionale con opere esposte in permanenza, nei più prestigiosi musei del pianeta.

Pluripremiato con riconoscimenti di grande rilievo, tra cui ricordiamo i numerosi Compassi d’Oro, dei quali l’ultimo è stato attribuito nel 2020 alla Lampada Arco. con la seguente motivazione: “Innovazione tipologica nel settore illuminotecnico, è stata capace nel tempo di diventare icona per l’intero design italiano nel mondo.“

Pier Giacomo Castiglioni riceve il suo primo Compasso d’Oro nel 1955

Pier Giacomo Castiglioni riceve il suo primo Compasso d’Oro nel 1955

Architetto

Pier Giacomo Castiglioni

Pier Giacomo Castiglioni è stato un architetto designer urbanista docente Italiano del XX secolo.

Oggi è riconosciuto come una figura di spicco nel mondo del design internazionale con opere esposte in permanenza, nei più prestigiosi musei del pianeta.

Pluripremiato con riconoscimenti di grande rilievo, tra cui ricordiamo i numerosi Compassi d’Oro, dei quali l’ultimo è stato attribuito nel 2020 alla Lampada Arco. con la seguente motivazione: “Innovazione tipologica nel settore illuminotecnico, è stata capace nel tempo di diventare icona per l’intero design italiano nel mondo.“

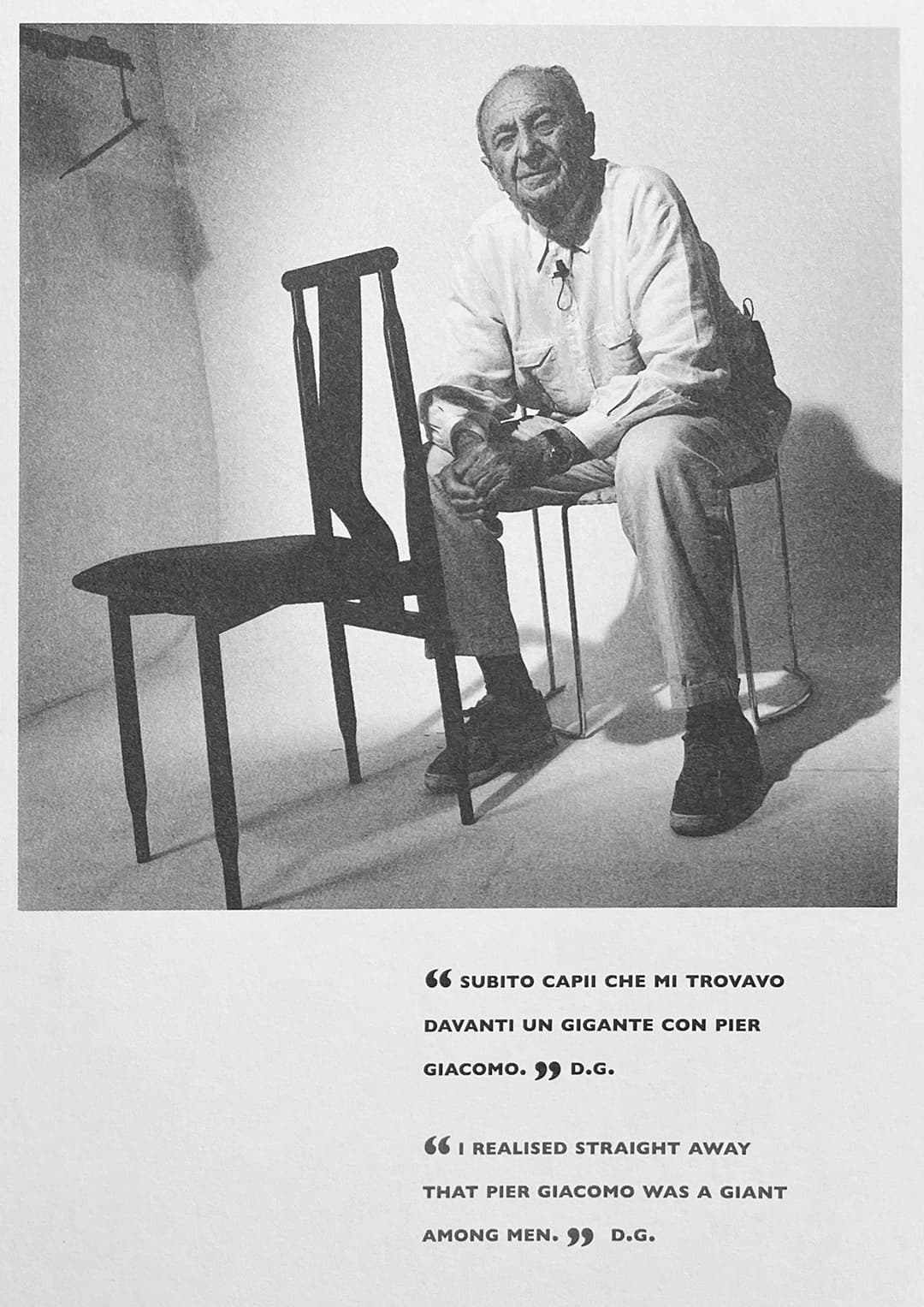

Ricordo di Dino Gavina

Dino Gavina definì “Pier Giacomo Castiglioni uno dei primi dieci designer al mondo“.

Per il 27 novembre 1998, a trent’anni dalla scomparsa di Pier Giacomo, Dino Gavina realizzò un piccolo libro celebrativo che riportiamo nella sua versione integrale e nella traduzione in Inglese.

1913-2024

Pier Giacomo Castiglioni

Ricorrono quest’anno i 111 anni dalla nascita dell’Architetto Pier Giacomo Castiglioni.

E’ tutt’ora in atto il progressivo ampliamento del sito: https://www.piergiacomocastiglioni.it/ nelle sue varie sezioni.

Particolare cura viene data alla ricostruzione della verità storica relativa al lavoro di Pier Giacomo Castiglioni anche attraverso i ricordi di chi l’ha conosciuto direttamente, come è possibile consultare nella sezione Memories, nonostante le infinite pubblicazioni che non lo associano correttamente ai suoi progetti.

Questo lavoro è utile e indispensabile per sensibilizzare e informare correttamente i giovani, che non dovrebbero essere fuorviati dai continui errori, omissioni, quando non addirittura – a volte – false rappresentazioni storiche che ne stanno progressivamente erodendo il ricordo.

Attraverso questo sito si vuole trasmettere la stessa passione, la tecnica, la visione di Pier Giacomo Castiglioni, Designer, Docente, Architetto, Urbanista, di spicco nella realtà Milanese e internazionale del XX secolo.

Lo scultore Giannino Castiglioni ha creato l’annuncio della nascita di Pier Giacomo Castiglioni

Lo scultore Giannino Castiglioni ha creato l’annuncio della nascita di Pier Giacomo Castiglioni

1913-2024

Pier Giacomo Castiglioni

Ricorrono quest’anno i 111 anni dalla nascita dell’Architetto Pier Giacomo Castiglioni.

E’ tutt’ora in atto il progressivo ampliamento del sito: https://www.piergiacomocastiglioni.it/ nelle sue varie sezioni.

Particolare cura viene data alla ricostruzione della verità storica relativa al lavoro di Pier Giacomo Castiglioni anche attraverso i ricordi di chi l’ha conosciuto direttamente, come è possibile consultare nella sezione Memories, nonostante le infinite pubblicazioni che non lo associano correttamente ai suoi progetti.

Questo lavoro è utile e indispensabile per sensibilizzare e informare correttamente i giovani, che non dovrebbero essere fuorviati dai continui errori, omissioni, quando non addirittura – a volte – false rappresentazioni storiche che ne stanno progressivamente erodendo il ricordo.

Attraverso questo sito si vuole trasmettere la stessa passione, la tecnica, la visione di Pier Giacomo Castiglioni, Designer, Docente, Architetto, Urbanista, di spicco nella realtà Milanese e internazionale del XX secolo.

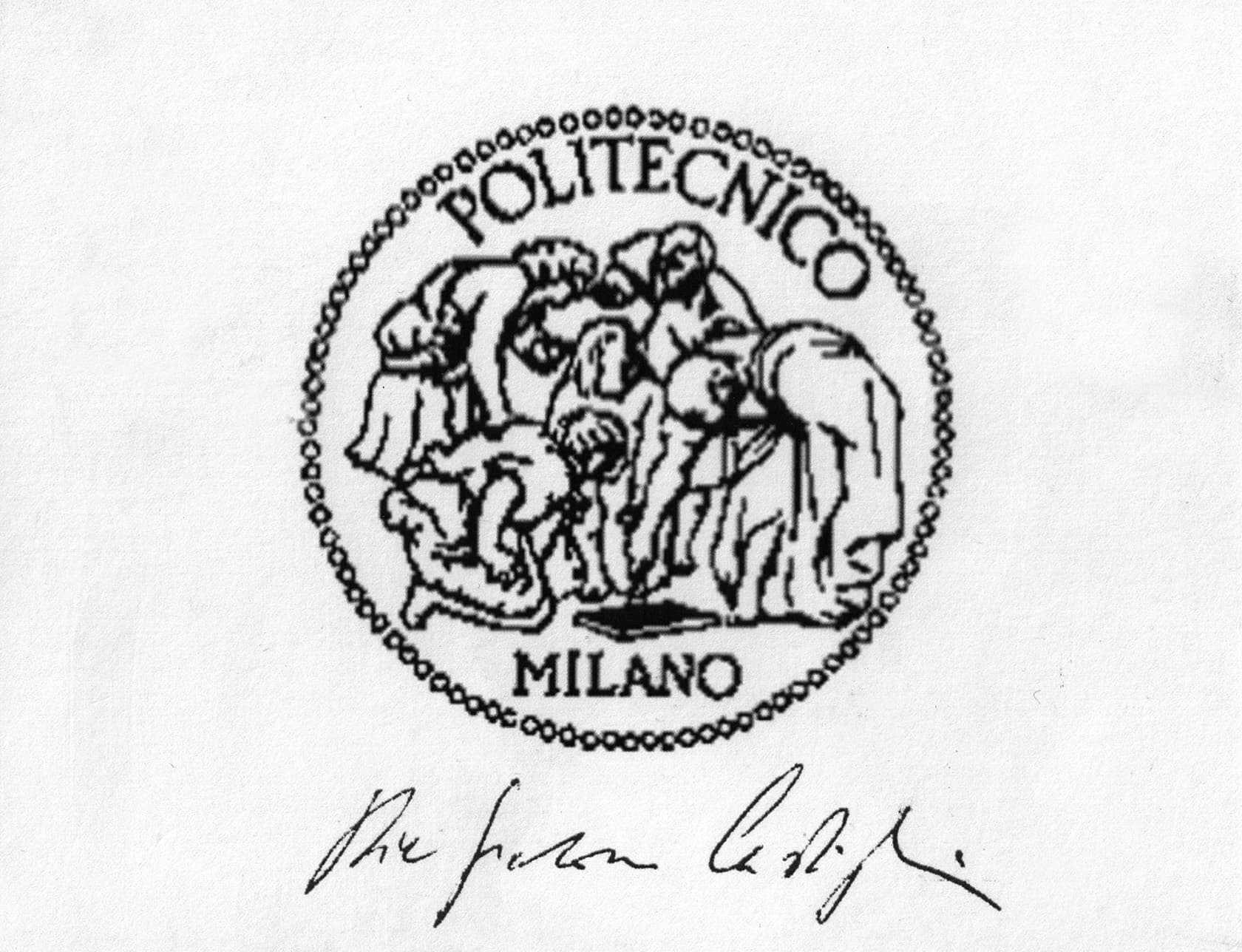

Sigillo Araldico del Politecnico di Milano

Pier Giacomo Castiglioni ha realizzato il Sigillo Araldico del Politecnico di Milano, vedi oltre il documento di ringraziamento del 30 giugno del 1944.

Il disegno rappresenta un dettaglio dell’affresco di Raffaelo Sanzio intitolato “La Scuola d’Atene“.

Catalogo

Progetti

La sezione dei progetti di Pier Giacomo Castiglioni è in costante aggiornamento.

Esplora spesso questa sezione per conoscere le realizzazioni dell’Architetto e scoprire gli aneddoti e tutte le più interessanti caratteristiche della vasta gamma di progetti realizzati, dall’Architettura, agli Allestimenti, all’Industrial Design.

Allestimento Montecatini

Colori e Forme della casa d’oggi

ALLESTIMENTI

ARCHITETTURE

INDUSTRIAL DESIGN

URBANISTICA